The Future of Payments in the Digital Age is Upon Us

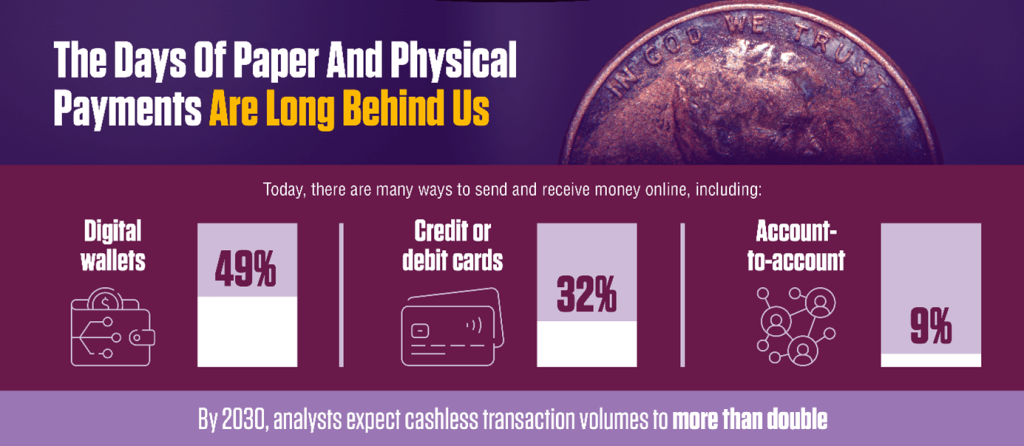

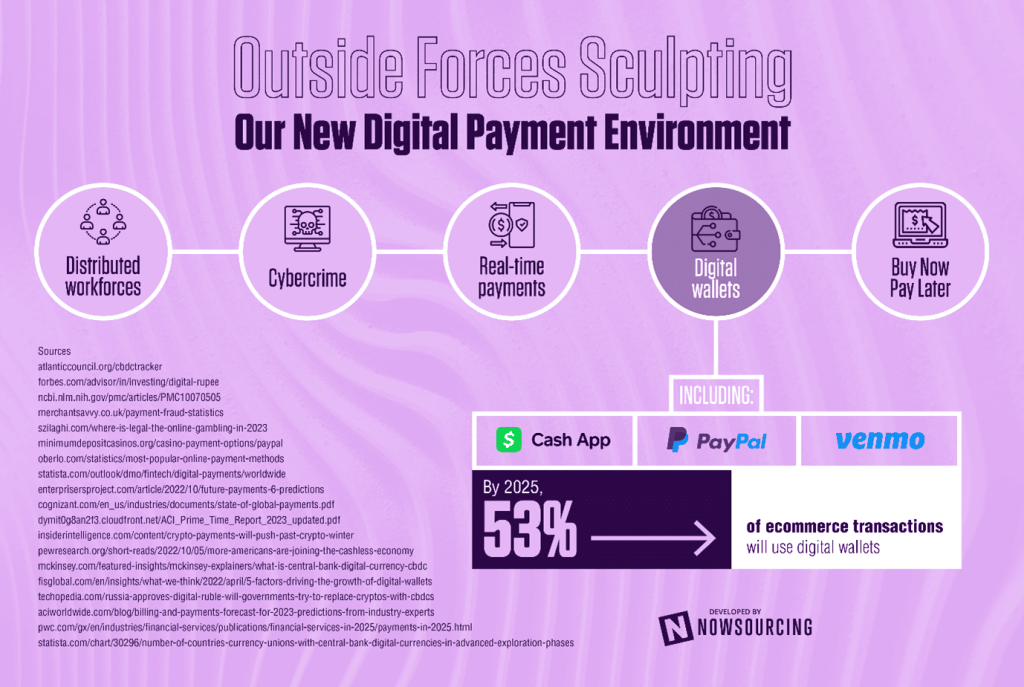

The world has evolved rapidly over the past few decades and so has transacting. Payment methods have seen an extraordinary shift from paperback to digital and by 2025, projections are that 53% of all ecommerce transactions globally will use digital wallets. By 2030, analysts expect cashless transaction volumes to more than double.

Paper money and physical transactions have lost relevance across the world, paving the way for the modern consumer – who prefer online buying, love throwing virtual goods into their e-shopping carts, and thrive on ‘drop at the door’ delivery options.

The global shift online

What accelerated this immense growth of digital payments was the COVID-19 pandemic, which forced companies and industries online, making room for a new, efficient, and secure way of transacting.

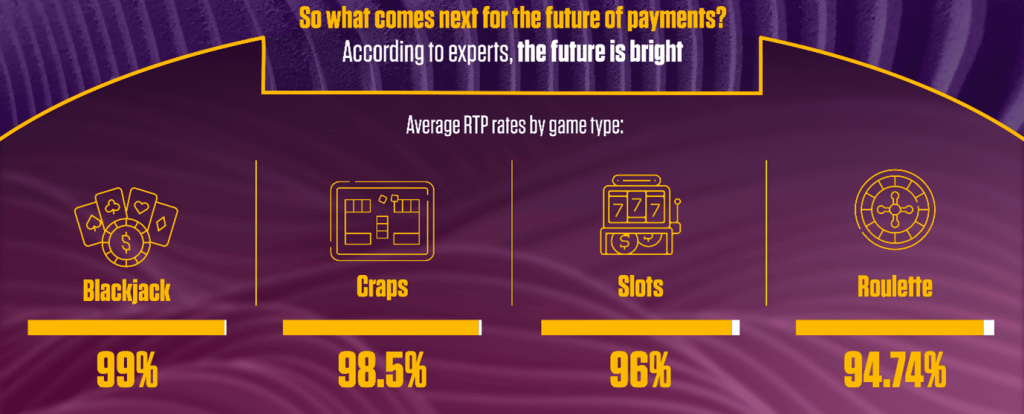

From the finance industry, to entertainment, sports, healthcare, and tourism – all sectors of society around the world were affected by the shift, which now also makes way for crypto and fiat currencies. One of industries most affected by the changing payment methods was online casinos. Did you know that 26% of people around the world gamble online on any given day? These are the people heavily reliant on safe online deposits and withdrawals. The great payment options that came into play broadened the transacting choices for people in different regions. Suddenly, there were many ways to send and receive money online. But the common are digital wallets (49%), credit or debit cards (32%), or account to account (9%).

Cryptocurrency and PayPal

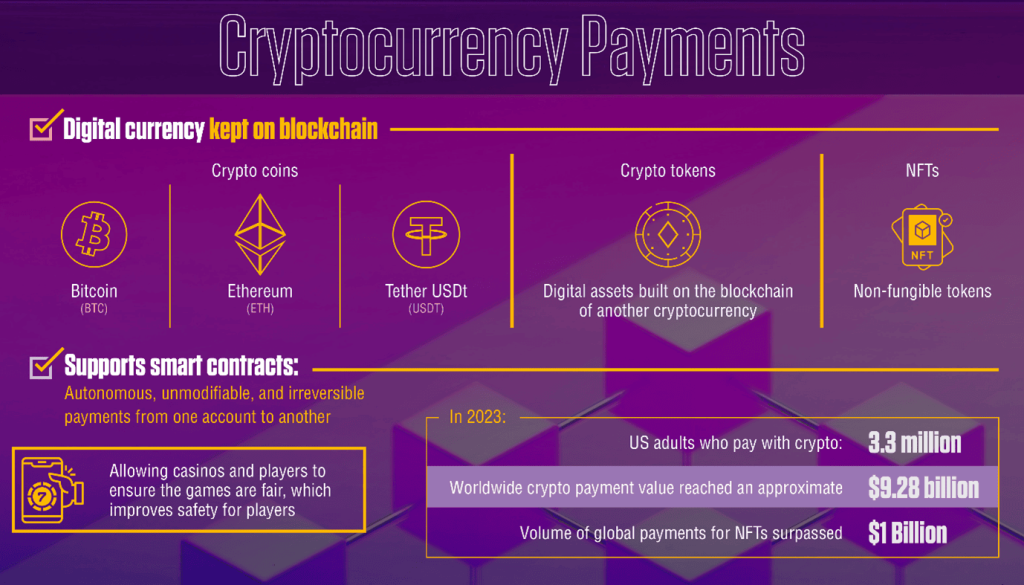

And still new payment methods are coming in at lightning speed. In fact, already on the horizon are cryptocurrency payments (which includes digital currency kept on blockchain). For online gamblers these include crypto coins (like Bitcoin, Ethereum, Tether; crypto tokens; and NFTs (non-fungible tokens). These support smart contracts and are autonomous, unmodifiable, and irreversible payments from one account to another. For casinos, these methods ensure an elevated level of safety for players.

In 2023, 3.3 million US adults used crypto currency for payments. Globally crypto payments reached around $9.28 billion, while NFTs surpassed $1 billion.

Another growing payment method globally is PayPal. According to Statista, it had 431 million users by the end of Q2 2023. The value of the transactions processed reached US$337 billion. PayPal saw incredible growth over the past few years and as of March 2023, 91% of online users in Germany and 84% in Brazil were using PayPal for online casino payments. For United States, the figures stood at 81% and Canada at 85% respectively. By 2023, PayPal became legal in specific areas within Europe, India, Ireland, Japan, Latin America, Malaysia, North America, Netherlands, and Sweden. It relies on a Bank ID, Trustly and Plaid.

Another type of payment method on the horizon is Central Bank Digital Currencies (CBDC). These include DCash (Eastern Caribbean); e-CNY (China); eNaira (Nigeria); e₹ or eINR (India); and Digital Ruble (Russia).

By 2023, some 11 countries had adopted CBDC including Nigeria, Anguilla, Jamaica, The Bahamas, Saint Kitts and Nevis, Antigua and Barbuda, Montserrat, Dominica, Saint Lucia, Saint Vincent and the Grenadines, as well as Grenada. Another 53 countries are already in advanced planning stages to adopt CBDC, while 46 others are still researching the topic.

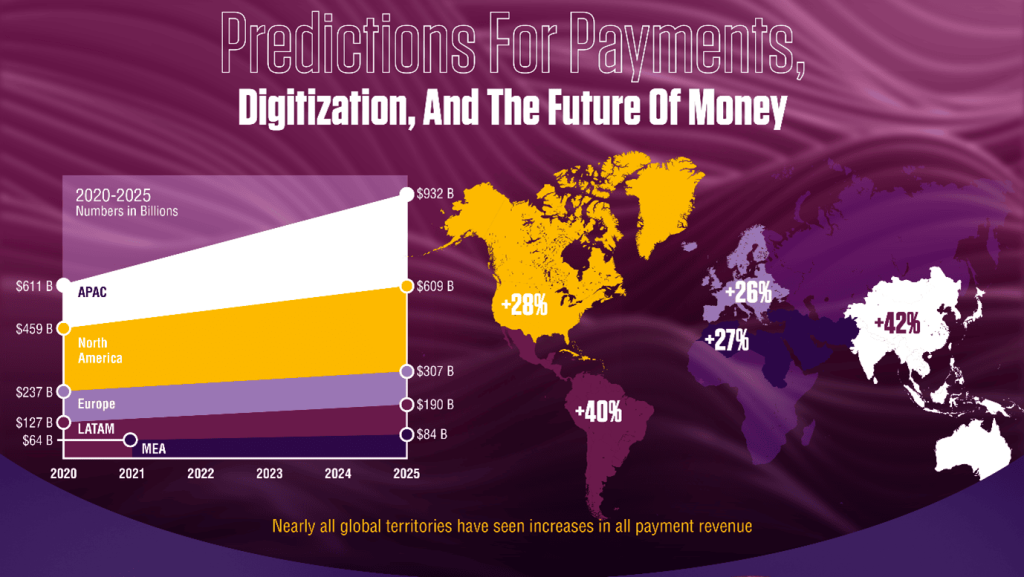

The Predictions for Payments Has Never Been Brighter

Nearly all global regions have seen increases in all payment revenues. APAC in 2020 stood at $611 billion in payment revenue and by 2025 this is expected to increase by 42% to $932 billion. North America’s payment revenue of $459 billion in 2020 is expected to hit $609 billion by 2025 (a 28% increase). Europe’s $237 billion in 2020 is projected to balloon by 26% to $307 billion by 2025, while LATAM’s $127 billion in 2020 will increase by 40% to $190 billion by 2025. The MEA region’s 2021 payment revenue of $64 billion is expected to grow by 27% to $84 billion by 2025.

What this means is that the days of paper money have gone the way of the dinosaur. Physical transactions are long behind us and by 2030, analysts expect cashless transaction volumes to increase rapidly.

Companies and industries need to prepare for the future of digital payments or risk falling behind their competitors who are paving the way for the modern consumer. All industries and societies are affected, including online casinos and igaming enthusiasts. So, get in gear and do not be left behind. The future of digital payments is already upon us. Are you ready?

About MDC

MDC stands as a pioneer in the digital payment revolution, offering a leading resource for online casino enthusiasts. With digital wallets becoming increasingly prevalent in global e-commerce transactions and cashless transactions on the rise, MDC remains agile in adapting to these transformative changes. Rooted in responsible gaming, MDC provides a secure and welcoming space for the growing community of online gamblers worldwide.

References:

- atlanticcouncil.org/cbdctracker

- forbes.com/advisor/in/investing/digital-rupee

- ncbi.nlm.nih.gov/pmc/articles/PMC10070505

- merchantsavvy.co.uk/payment-fraud-statistics

- szilaghi.com/where-is-legal-the-online-gambling-in-2023

- minimumdepositcasinos.org/casino-payment-options/paypal

- oberlo.com/statistics/most-popular-online-payment-methods

- statista.com/outlook/dmo/fintech/digital-payments/worldwide

- enterprisersproject.com/article/2022/10/future-payments-6-predictions

- cognizant.com/en_us/industries/documents/state-of-global-payments.pdf

- dymit0g8an2f3.cloudfront.net/ACI_Prime_Time_Report_2023_updated.pdf

- insiderintelligence.com/content/crypto-payments-will-push-past-crypto-winter

- pewresearch.org/short-reads/2022/10/05/more-americans-are-joining-the-cashless-economy

- mckinsey.com/featured-insights/mckinsey-explainers/what-is-central-bank-digital-currency-cbdc

- fisglobal.com/en/insights/what-we-think/2022/april/5-factors-driving-the-growth-of-digital-wallets

- techopedia.com/russia-approves-digital-ruble-will-governments-try-to-replace-cryptos-with-cbdcs

- aciworldwide.com/blog/billing-and-payments-forecast-for-2023-predictions-from-industry-experts

- pwc.com/gx/en/industries/financial-services/publications/financial-services-in-2025/payments-in-2025.html

- statista.com/chart/30296/number-of-countries-currency-unions-with-central-bank-digital-currencies-in-advanced-exploration-phases